Securing consumer relevance while mitigating sustainability outcome challenges…

You might agree, improved sustainability performance in our food system is challenging to achieve. Concurrently, staying ahead of shifting consumer sentiments is equally difficult. Both are essential to continued progress in transforming how food and beverage are created while driving appeal to those that will buy environmentally-responsible products.

Two new studies on the topic, one from Bain and the other from Sustainable Brands, show some alignment on key areas of consumer insight.

Here we will provide an update on consumer behaviors that impact the potential growth of business opportunities, while reflecting on the systemic challenges inherent in getting products optimized for the three criteria driving business growth:

Delicious. Healthy. Sustainable.

Both reports detail disconnects that stand in the way of progress to connect the dots between corporate sustainability efforts, product efficacy and results at the point of sale.

- Putting to rest the #1 myth about consumer sentiment: Sustainability activism and interest are not exclusively the province of politically left-leaning, progressive liberal mindsets espoused by a small fringe cohort of conscious consumption advocates. Rather, 72% of consumers across all age segments consider themselves to be sustainable, ethical consumers. Yet there remains distance between this self-assessment and their marketplace behaviors.

- Remarkably, the predominant interest in sustainable choice is important to Boomers as much as it is Gen Z.

- Gen Z consumers are not all activists and more than half of them are less likely to act on their preferences due to perceived barriers (cost, lack of choice).

- Among the barriers, is the inability to truly distinguish which products are sustainable vs. those that aren’t.

- Consumers universally remain skeptical of companies’ ability to deliver change and operate in the best interest of people and the planet ahead of profit. Brands need to address this.

- Younger cohorts feel more pressure to align with sustainable living, thus are more actively willing to switch brands from habitual choices when trying to execute of their priorities.

- Absence of choice: consumers believe there are not enough sustainable options across categories that matter to them, frustrating their desire to live more sustainably. This operates like a brake on behavior.

- Ironically, however, they think exercising their preference and choice for sustainable options while shopping is their primary path to being influential on creating a more sustainable lifestyle and environmentally healthy planet.

- Nearly half of consumers believe living sustainably is too expensive.

- Even so, consumers are willing to pay more for sustainably-made products.

- However, the acceptable sustainability upcharge is in the range of 12%, not the average 28% premium consumers frequently experience, especially in the U.S.

- Consumers want more information and believe companies must share specifics about what they are doing to address sustainability challenges in the products they provide.

- They also believe companies and brands are not doing enough to communicate their sustainability bona fides. This can be addressed via investment in education.

- While greenwashing – messages that get ahead of real, authentic performance – isn’t helping anyone secure trust and belief in the efficacy of what’s said and on offer.

Sustainable Brands’ survey of 23,000 consumers revealed this summary of how consumers shake out along the spectrum of “act now” to “don’t care”:

Activists: 17% – the situation is critical, and we must act now before it’s too late

Pragmatists: 28% – they are concerned, aware and watching yet actions are more limited

Conflicted: 19% –they care as well but pocketbook considerations remain the top priority

Busy bystander: 19% – also concerned but this is less important right now

Disengaged deniers: 17% – nope, just not buying into it.

For your next internal update report, here are some data points on where consumers (by generational segment) are relative to hot button topics.

Companies are not doing enough to address their sustainable performance:

Gen Z – 80%

Millennial – 77%

Gen X – 72%

Boomer – 69%

Will switch brands when presented with a more sustainable choice:

Gen Z – 75%

Millennial – 79%

Gen X – 70%

Boomer – 67%

Are willing to pay more for sustainable choice:

Gen Z – 72%

Millennial – 69%

Gen X – 60%

Boomer – 56%

In answering where they go to secure reliable information on which to base their decisions, consumers cited these sources in descending order of priority in their behavior:

- Product packaging and label communication

- Reading reviews

- Looking at company websites and social channels

- Asking friends and family

- Checking out third-party certifications

- Checking for information at retail stores

All of these behaviors and preferences, however, spin on the head of actual performance by brands to create authentically more sustainable products that also meet considerations on taste and price point.

- What we can tell from the consumer data is confirmation of a cultural shift that will become one of the biggest levers of competitive marketplace advantage in the years ahead. This means the current predominance of silos separating sustainability leadership from marketing strategy must collapse.

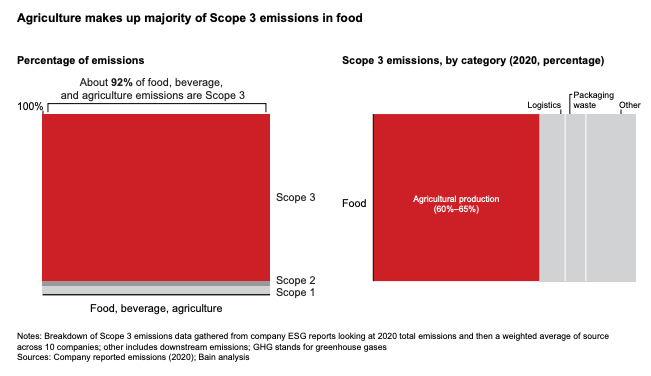

That said, the thorniest of all issues brands will confront on the path to more sustainable outcomes and performance are efforts to address the current System 3 mitigation crisis that dogs the industry. Why is this so important? Because of the role the supply chain and all its complexity plays to reduce carbon emissions – far more important than any other area of sustainable standard and policy.

This chart from Bain reveals the significance:

Where does all of this lead?

The time to act is now. Separation and elevation for environmentally-relevant brands and businesses will continue to grow. It’s power as a regulator of market share growth and brand differentiation will only increase.

Here’s how Bain characterizes the challenge:

“Incumbent consumer goods companies will continue to cede growth to insurgents that are doing a better job of serving consumers’ rising demands for healthier (and more sustainable) food. Companies across the food chain will find themselves losing out amid the scarce supply of limited raw materials that meet environmental standards. They’re already lagging in the war for top talent. A telling fact: No agribusiness or food producer was named in the Fortune 100 Best Companies to Work For list in 2023.”

“By our analysis, food companies that seize the initiative can benefit from a potential 15% five-year revenue uplift compared with a 43% revenue decline for companies that fall behind based on a scenario of increasingly aggressive regulation.”

Companies can begin this journey into the future by asking and answering a series of fundamental questions.

- How are we contributing—both positively and negatively—to the health and environmental footprint of the food system?

- How might environmental, health, consumer, technology, and regulatory dynamics/developments affect the food industry over the next 10 years?

- What will the agri-food company of the future—and our company—need to look like in 10 years?

- How do we scale our regenerative agriculture and portfolio reinvention priorities?

- How can we better mobilize our entire organization?

At Emergent we see sustainability performance and leadership as a decisive move for business growth and brand purpose leadership. As you consider the facts arrayed here, if you have questions in your mind about sustainability readiness and best practices, use this link to start an informal conversation about your concerns.

Looking for more food for thought? Subscribe to the Emerging Trends Report.

Bob Wheatley is the CEO of Chicago-based Emergent, The Healthy Living Agency. Traditional brand marketing often sidesteps more human qualities that can help consumers form an emotional bond. Yet brands yearn for authentic engagement, trust and a lasting relationship with their customers. Emergent helps brands erase ineffective self-promotion and replace it with clarity, honesty and deeper meaning in their customer relationships and communication. For more information, contact [email protected] and follow on Twitter @BobWheatley.